Ethereum Bullish Foundations Strengthen with 800K–1M New Wallets Created

Ethereum prices hold steady at $2,bitcoin in usd calculator500 while network growth, whale accumulation, and ETF inflows hint at a bullish breakout.

As the broader crypto market maintains a sideways trend, Ethereum holds ground at $2,500. Despite quiet price movement, the utility and network growth, and increased whale support signal a potential bull run ahead.

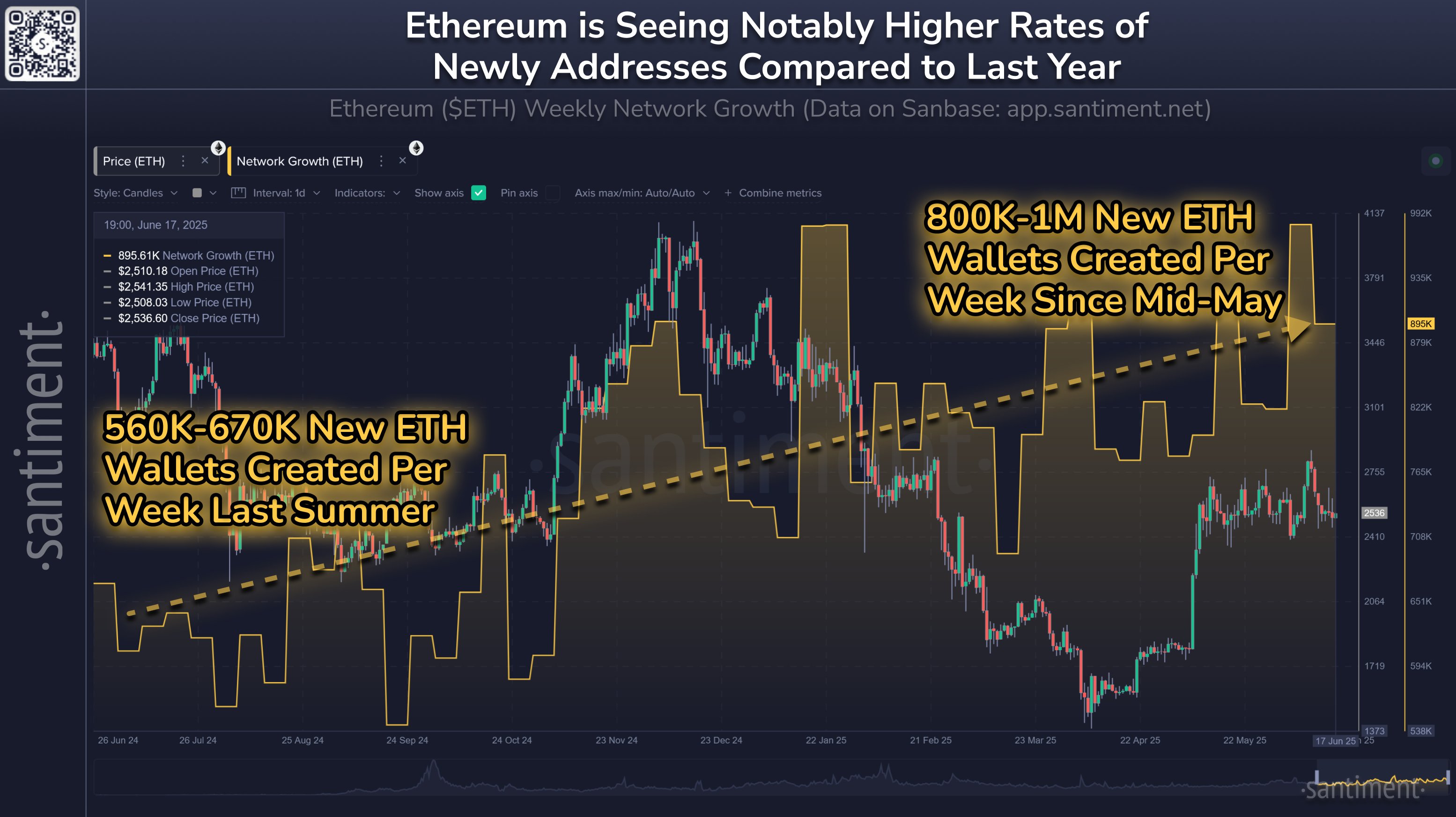

Ethereum Network Growth

In a recent tweet, Santiment, the on-chain analytics platform, highlighted Ethereum’s increased utility and network growth. The number of new weekly Ethereum addresses created has surged from 560k–670k last summer to 800k–1 million since mid-May. With more addresses being created on Ethereum, the fundamentals flash a bullish sign.

- Advertisement -Whales and Institutions Acquire More Ethereum

Amid the rising network activity, IntoTheBlock data highlights an increase in holdings by investors with more than 1 million ETH. Over the past three months, their combined portfolio expanded from 67.81 million ETH to 70.87 million ETH.

Remarkably, the collective holdings of investors with more than 10,000 ETH have surged 24 million tokens. With increased confidence from whales, Ethereum is likely to witness a bullish reversal.

Ethereum Balance by Holdings | IntoTheBlock

Alongside crypto whales, institutional support is also on the rise for Ethereum. The daily net inflow into U.S. Ethereum spot ETFs on June 18 was $19.10 million. This marks the third consecutive day of inflows after a minor outflow of $2.18 million on June 13.

Overall, the monthly inflow so far totals $860.77 million, raising the total net assets in U.S. Ethereum spot ETFs to $9.94 billion.

- Advertisement -Ethereum Derivatives

In the derivatives market, optimism remains strong as Coinglass data shows open interest at $34.96 billion, with a minor increase of 0.65%. Over the past 24 hours, liquidations are almost evenly split: long liquidations at $9.4 million and short liquidations at $8.51 million.

However, short positions still marginally outnumber longs, with the long-to-short ratio at 0.9853. Nevertheless, bullish trading activity in Ethereum derivatives continues to grow, with the open interest-weighted funding rate rising to 0.0074%.

Ethereum Derivatives

Ethereum Price Analysis

On the daily chart, Ethereum maintains a sideways trend slightly above $2,500, as noted in our previous analysis. While momentum indicators remain bearish to neutral, lower price rejection in daily candles signals the possibility of a bullish turnaround.

The immediate resistance for Ethereum lies at the 50% Fibonacci retracement level of $2,699. If Ethereum surpasses this level, the uptrend could extend toward the 61.8% Fibonacci level near the $3,000 psychological mark.

On the downside, crucial support remains at $2,395.

-

Bitcoin (BTC) Moving Close to $47K, Altcoins Also Faced Price SurgeMemecoin (MEME) Airdrop Goes Viral With 2.35B Tokens worth $52M Claimed Amid High Profile ListingBrazil Embraces Blockchain for Enhanced Digital Identity VerificationXRP Liquidations and Lagging Price Cast Doubt on Overhyped RallyHAI Token Drops After Private Key LeakWhy is XRP Rising, Something Big Coming for XRP in Ripple Swell?XRP Now Available in 72 Countries With Combined GDP of over $8 TrillionCanada Issues Preliminary Guidelines for Stablecoin TradingDecentralized AI Multiverse Acquires $15M From Leading Blockchain VCSpeculation Suggests Google is Running an XRP Ledger (XRPL) Node: Here are Facts

下一篇:Nexon: Japanese Gaming Giant Invests In Bitcoin Worth of $100M

- ·Ethereum Improvement Proposal 3675 Created for Forthcoming Chain Merge

- ·Shiba Inu Showcases Prime Setup for Bullish Breakout

- ·Uptober: A Promising Month for Bitcoin (BTC)?

- ·Top Lawyer Highlights How Ripple Can Secure 99.9% Victory Against SEC

- ·Top 4 Crypto Games IGO Launchpads

- ·Bitcoin Halving Nears: Weekly Top 5 Cryptos To Watch – XRP, SOL, BNB, ADA, MATIC

- ·Former SEC Chair Wants Investigation of SBF Political Donations

- ·INOCYX Forms Historic Collaboration with Software Technology Parks of India

- ·Crypto Staking in 2025: SEC’s New Rules Make These Methods Fully Legal

- ·ApeX Protocol Unveils Telegram Bot for Decentralized Derivatives Trading

- ·ApeX Protocol Unveils Telegram Bot for Decentralized Derivatives Trading

- ·Analyst Explains Why XRP Should Be Standard for Cross

- ·Bitci Technology Signed an Agreement With McLaren Racing

- ·VeChain Welcomes Over 21K New Addresses in a Day, as Total Wallets Surge to 2.28M

- ·Several Ether Futures ETFs Go Live Including VanEck’s

- ·Polygon (MATIC) Sees More Active Addresses and NFT Volume in Stellar Quarter

- ·Tokenized Government Debt: A Growing Risk to Crypto Markets

- ·Cardano Faces Pivotal Moment Amid Mixed Indicators for Short Term

- ·Will Uptober Pump Bitcoin Past $30000?

- ·Top Whale Moves 4.4T Shiba Inu As SHIB Burn Rate Surges 1300%

- ·Top 3 Play to Earn Project Based on 7 Days Gain

- ·Why is XRP Rising, Something Big Coming for XRP in Ripple Swell?

- ·Cardano Price History Hints at Potential 43.5% Surge in November

- ·Here Are Returns on 10K, 50K, 100K XRP Holdings if XRP Hits $5, $10, $50 or $100

- ·Bitcoin Critic Warren Buffet Invests in a Digital Bank

- ·SEC Faces Another Loss as XRP Holders Never Lost Money Because of Ripple

- ·Top 3 Avalanche Ecosystem Tokens by Volume

- ·Crypto Exchange Gemini Halts Operations in the Netherlands

- ·Crypto Exchange Gemini Halts Operations in the Netherlands

- ·Bitcoin (BTC) Price Striving Hard Post Brief Retracement

- ·Microsoft Closes Azure Blockchain Service

- ·Cardano TVL in ADA Surges to ATH as DJED Stablecoin Hits 390% Collateralization

- ·Bitcoin Price Crosses $28,000; Witnesses Strong Bullish Rally

- ·Accounts Holding 100,000 to 1 Billion XRP Hits Year High as Price Decouples from Bitcoin

- ·Over $1.2 Billion Worth of ETH Withdrawn From Centralized Exchanges

- ·Ethereum Nears $1,650 Resistance. Time to Long or Short?